A richly-diversified and resilient market

Focusing on the rapidly growing safety and security sector, the strategy seeks to contribute to the protection of assets, data, goods and people’s health, while generating long-term capital growth.

Capabilities

Find out more about our investment capabilities

Services

Find out more about the full scope of our solutions offering

Funds

Search for funds, documents, and notifications

Funds by asset class

Search for funds within each asset class

Funds by investment manager

Find funds run by each of our affiliated investment managers

Insights by asset class

Gain our perspectives and investment thinking across each asset class

News and insights

Get deep insight and expert views on the forces shaping financial markets

Featured topics

Browse the latest views by topic

Who we are

Find out more about who we are and how we might be able to help

Investor sentiment

Discover the latest insights from the center for investor insight

Focusing on the rapidly growing safety and security sector, the strategy seeks to contribute to the protection of assets, data, goods and people’s health, while generating long-term capital growth.

*Mirova, Safety universe average sales 10Y Compound Annual Growth Rate, as of December 2022. Past performance is not necessarily indicative of future performance.

Their pure play approach focuses on maximising the ability to generate excess returns through different market cycles. This includes thematic alpha, by identifying the best long-term themes and investment universes, as well as generating value through diligent stock picking and analysis. In order to maximise long-term performance, their strategies aren’t limited to certain benchmarks, regions, countries, or company sizes.

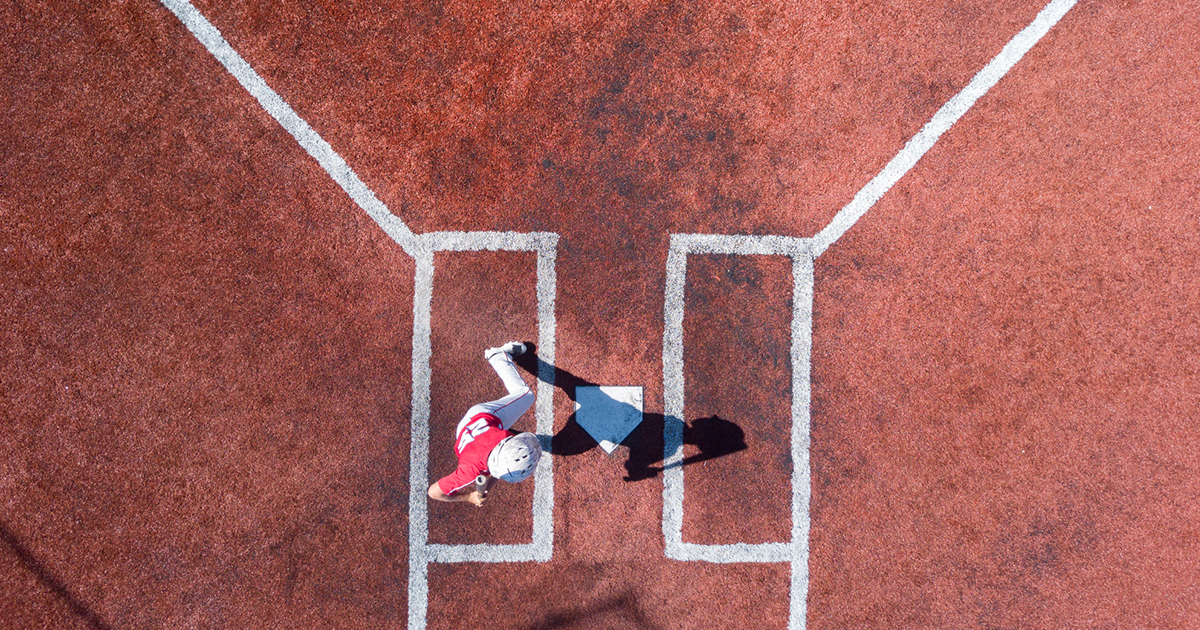

The Thematics Safety strategy seeks to capitalize on the basic human need for safety identified by Abraham Maslow in his ‘Hierarchy of Needs’. The market for the safety of individuals, businesses and governments is a diversified and resilient universe and spans both the real world and the digital world.

Mirova believes being active is key to long-term success. Even if a theme is viable, investors need to identify the winners while avoiding the losers, something passive products can’t do. Being active is also key to delivering repeatable performance. At the core of their approach, Mirova remains laser-focused on fundamental analysis, valuation discipline and stock selection.

The analyses and opinions referenced herein represent the subjective views of the author(s) as referenced, are as of the date shown and are subject to change without prior notice.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. There could be other differences across similar products in the same strategy. Investors should fully understand the risks and other relevant details associated with any investment prior to investing.

A committed player and a leading player in sustainable finance, Mirova is a conviction-based management company that offers its clients investment solutions combining the search for financial performance with environmental and social impact. This is their raison d'être: to contribute to a more sustainable and inclusive economy by increasing their positive impact on environmental issues, but also on reducing inequalities.

As ‘Mission-led company’1, thanks to multidisciplinary teams united around the same vision, the variety of their areas of expertise, and their ability to innovate and create partnerships with the best experts, they seek to direct capital towards the needs of investment in a real, sustainable and value-creating economy.

Mirova is internationally recognised BCorpTM2 certification attests to their environmental and social commitment.

(1) Introduced in France in 2018 under the Pacte Law, a ‘société à mission’ company must define its "raison d'être" and one or more social, societal or environmental objectives beyond profit. The purpose, and objectives aligned with this purpose, must be set out in its Articles of Association. The Articles specify the means by which the execution of the Mission will be monitored by a Mission Committee (a corporate body distinct from the board of directors which is responsible for monitoring the implementation of the mission with at least one employee.) An independent third party then verifies the execution of the Mission, via a written opinion which is annexed to the report of the Mission Committee to shareholders and made available on the website of the company for a period of five years.

(2) Since 2006, the B Corp movement has been promoting strong values of change throughout the world to make businesses “a force for good” and to distinguish those which reconcile profit (for profit) and collective interest (for purpose). B Corp’s goal is to certify companies that integrate social, societal and environmental objectives into their business model and operations.